Financial Health Check

The starting point in that journey is an initial consultation that is your financial health check.

- How good is your financial Health?

- Are you on track to achieve your short- and long-term goals?

- Are you prepared for unforeseen events that may throw your plans off track?

All your personal financial needs are covered

Through a combination or our expertise and a range of strategic partnerships we can help with all your personal financial needs.

Options to suits your situation

You can choose from three levels for your Financial Health Check starting at $330. Please see below for a detailed description of each.

Convenience

Consultations can be done at our office or via an online face to face meeting.

One off consultation

$330

Suitable if:

You have a specific issue to address. Maybe, you want to understand the financial implications or your plans before you make a decision.

Includes:

A consultation with one of our specialist advisers.

Relevant General Advice and the Factual Information you need to make an informed decision.

Financial Health Overview

$550

Suitable if:

You are generally comfortable with your overall financial health, but you want to make sure you are not missing something.

You want an idea of the areas you should be addressing to improve your financial health and would like some guidance on how to do that.

Includes:

A questionnaire for you to fill out before the consultation.

A consultation with one of our specialist advisers that will identify what areas you may need to address.

An Action list for you.

An introduction to the right professionals if required.

Comprehensive Financial Health Check

$1,375

Suitable if:

You want to make sure you are on the right track financially.

You want to make sure you have everything covered and you are not missing something.

You want help to develop a plan to address the areas you need to improve your financial health.

Includes:

A questionnaire for you to fill out before the consultation.

A report on the areas of your personal finances that you need to address.

A workshop of the Report with one of our specialist advisers.

A plan of action to implement strategies to improve your personal financial position over time.

Comprehensive Financial Planning

- Our process is to work with you to prepare an initial Financial Plan that encompasses all the various elements of your financial success. This will involve looking at your individual situation, discussing what you have in mind for the future and preparing a plan to help you get there.

- The first step is to have a clear vision about your purpose and understand what your financial goals, needs and objectives look like in measurable terms.

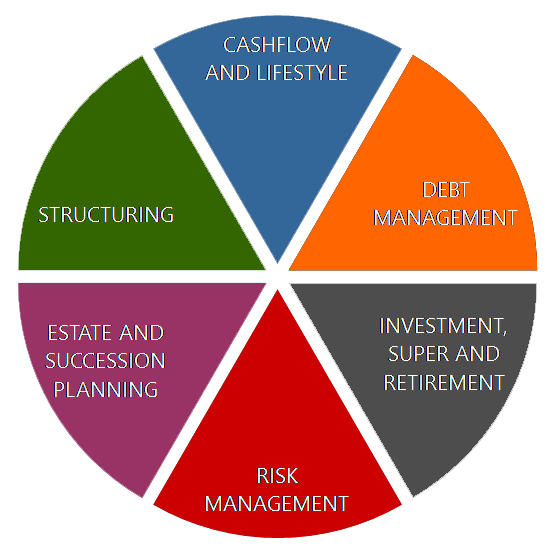

- We have a structured process to identify those needs and then break them down into six areas that should be addressed over the short, medium and long term.

- One of the elements is your investment portfolio, but you can see that the comprehensive plan is much broader than that.

Professional Fees

- Our method of payment is by an agreed fee. We do not charge commissions on investments through new superannuation, managed funds or retirement products. The fee depends on the nature of the advice or service we provide. All fees and charges include GST.

- The fee for a comprehensive Statement of Advice is $4,400 and an additional $880 if there is a SMSF involved.

- If the advice is in relation to an investment portfolio, then we require you to also engage us for our ongoing stewardship of your portfolio for the first year. There are several options and different levels of service, starting from $2,230 per annum

The Next Step

- To get the process started on your financial plan just let me know that you are ready to go ahead and we can book in a fact find meeting at a time that is suitable to you.

- At this meeting I will take you through our Personal and Financial Questionnaire and I would ask that you allow up to 2 hours for the meeting. As part of the process, I will ask you about:

- Your current financial position

- Your income and expenses

- Your lifestyle goals and objectives

- The things that are important to you

- Any financial concerns you have

- By collecting this information, it allows me to take all your circumstances into account in determining the best financial planning strategies for you.

- I will gather as much information as I can from your records at ATM Consultants and discussions with your Client Manager, but to assist the process can you bring along the following information:

- Details of your current income

- A list of Assets and Liabilities

- Your latest bank and mortgage statements

- Your latest superannuation statements

- Details of any personal insurance you have such as Life, TPD, Trauma or Income Protection – either in super or outside of super

- Your Drivers Licence or Passport

- A utilities bill showing your name(s) and address.

About ATM Financial Consultants Pty Ltd

Over recent years we have recognised that many of our clients are starting to really think about retirement and how they go about getting there. They have been looking for financial planning advice and want that advice from us rather than have us refer them to someone else.

As a result, ATM Financial Consultants Pty Ltd opened for business, offering a suite of financial planning services specifically tailored to the needs of our clients and designed to complement the business and tax advisory services we already offer.

Partners

We have partnered with FM Financial who are a Financial Planning Business with a highly skilled and experienced team with offices in Burnie, Devonport, and Hobart as well as Melbourne.

We are headed up by Stephen Jones who is an authorised representative of Hillross Financial Services (AFSL 232705). This gives you the best of both worlds. You can expect that personalised client focused advice that you get from dealing with a privately owned and managed business, but with the support and services of one of Australia’s largest and most established financial services organisations.